Why Dollar-Cost Averaging Beats Buying the Dip

“Happiness requires presence”

“Happiness requires peace”

—The Buddhist Investor

Dear investor,

As you are likely aware, we’re currently living in a world of abundance. For better or worse, we have too much food, too much news, too much entertainment, too much information, generally speaking too many options.

Overall, people think it’s positive to have unlimited choices, but it actually causes more stress and can make us feel overwhelmed.

When it comes to investing, you can find an endless stream of information on the internet. But, do we have the capacity to deal with such a large amount of information? The answer is no, definitely not!

New investors who are thinking about investing in the stock market need to educate themselves before investing, and this process takes time since you have to develop yourself as an investor.

It’s really important to find an investment philosophy that fits with your inner character and personality. Remember it’s your money that's on the line, and you don’t want to risk it all without being properly prepared.

If your goal is to pick your own stocks, don’t be in a rush. First, learn to understand the language of any business; understanding accounting and valuation might be challenging, but it is necessary if you want to properly comprehend how companies work. Furthermore, you need to be aware of the psychological behavior of the stock market; getting a grip on your emotions is essential to successful investing.

Okay, but all this learning process takes time and you probably don’t want to lose any present investment opportunities that could arise, right?

Don’t worry, I propose a simple solution for you…

My solution it’s called the dollar-cost averaging strategy. Basically, this practice involves building investment positions by investing fixed amounts of money at equal time intervals, as opposed to simply investing a lump all at one time.

For instance, investing a fixed amount monthly is a common example. The main advantage of this strategy is that it reduces the impact of volatility in your overall purchases. Investors avoid the risk of making counter-productive decisions out of greed or fear, such as buying more when prices are rising or panic-selling when prices decline. With this strategy, you will be buying every month regardless of what the stock market does. If the market goes up, you buy. If the market goes down, you buy. In other words, you don’t care about stock picking.

The great thing about this strategy is that it forces you to stay invested in the stock market all the days of the coming years. Some investors try to avoid the worst days in the market by selling their positions in order to anticipate corrections. However, missing the worst days in the market, most probably means that you will also miss the best days in the market.

Now imagine the people who think they can buy the dips each year, in real-time, and only put their cash in at that very moment. Unfortunately, they have no such ability to know when that lowest point will be and no way to be sure they're to buying in at the best possible time.

Investors holding back from investing because they assume they can identify a better entry point sometime in the future cannot actually do this consistently over time. What is more likely is they'll suffer opportunity cost and frustration.

As mentioned by Peter Lynch, “Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in corrections themselves.”

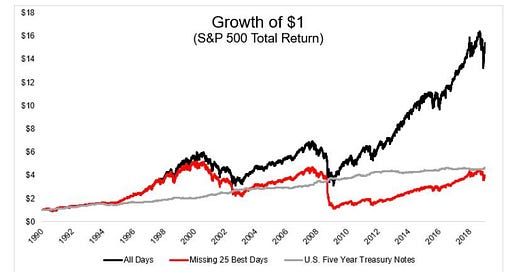

If you still don’t believe it, check the chart below:

Trying to avoid corrections and missing the 25 best days in the market makes a big difference in your overall return. Stay invested no matter what and forget about forecasting the exact low point of the stock market.

For those investors who are starting in their investment journey, I recommend applying the-dollar cost averaging strategy with an index fund or an exchange-traded fund (ETF) that replicates the performance of a stock market index. This great strategy helps novel investors to take the necessary time to educate themselves while their money is already passively compounding, almost effortlessly. Using this strategy, novel investors avoid the fear of missing out can take the necessary time to properly learn before making their own stock picks.

Personally, when my investment journey began many years ago, I started investing using this strategy. Today, it is a great complement to my overall portfolio.

Let’s see a practical example:

The S&P 500 is a market-capitalization-weighted index of the 500 largest publicly traded companies in the U.S. Its historical average return is around 8% to 10% annually.

Assume that you invest a monthly fixed amount through an index fund or an ETF. Here is the ending balance you could expect to achieve assuming an average annual return around 8% to 10%:

$200/monthly during 30 years—> $300,059 - $455,865

$300/monthly during 30 years—> $450,088 - $683,798

$500/monthly during 30 years—> $750,148 - $1,139,663

$1,000/monthly during 30 years—> $1,500,295 - $2,279,325

$2,000/monthly during 30 years—> $3,000,590 - 4,558,651

As you see, depending on the monthly investment amount and your average annual return, your ending balance could be higher or lower.

Novel investors would do well on applying this strategy while they are in the process of learning the important and necessary skills to become successful investors. As time goes by, and they become more experienced, they will realize that even professional investors apply this strategy in their stock picks. When professional investors are purchasing stock of one company, they tend to slowly build the full position usually within months. They don’t try to buy all at once or forecast the exact lowest point of entry.

Also, if you don’t really have the time or willingness to learn and educate yourself about investing and finance or you think active investing strategies are nonsense, you can apply this strategy since it’s completely effortless and passive. It’s doesn’t require you to do long hours of research, something that otherwise is essential when performing stock picking.

This strategy is meant for everyone. Whether you are a novel investor or an experienced one, this strategy will definitely help you compound wealth over time.

Remember, I truly recommend you start making your own investment decisions today and take control of your financial destiny. Let your money get to work for you no matter your age or situation. It’s never too late to start investing. Compounding wealth takes time and patience so you better start now.

Thank you for your support, and all the best in your journey to become a successful investor.

Yours truly,

The Buddhist Investor